The XRP price is technically bullish but presently ranging inside an eight-cent zone. This follows gains of December 16 and the absence of confirmation despite most XRP traders being bullish, expecting more gains.

At the time of writing (Dec 21), the XRP/USD price is trading at $0.56, adding eight percent in the last week of trading but losing ground on the last day.

XRP Price Overview for December

From the above, it is evident that buyers have the upper hand.

Even so, the stagnation could provide room for sellers. As such, they may drive prices lower, back inside the Dec 16 bull bar, and providing better opportunities for value and aggressive traders buying the dips.

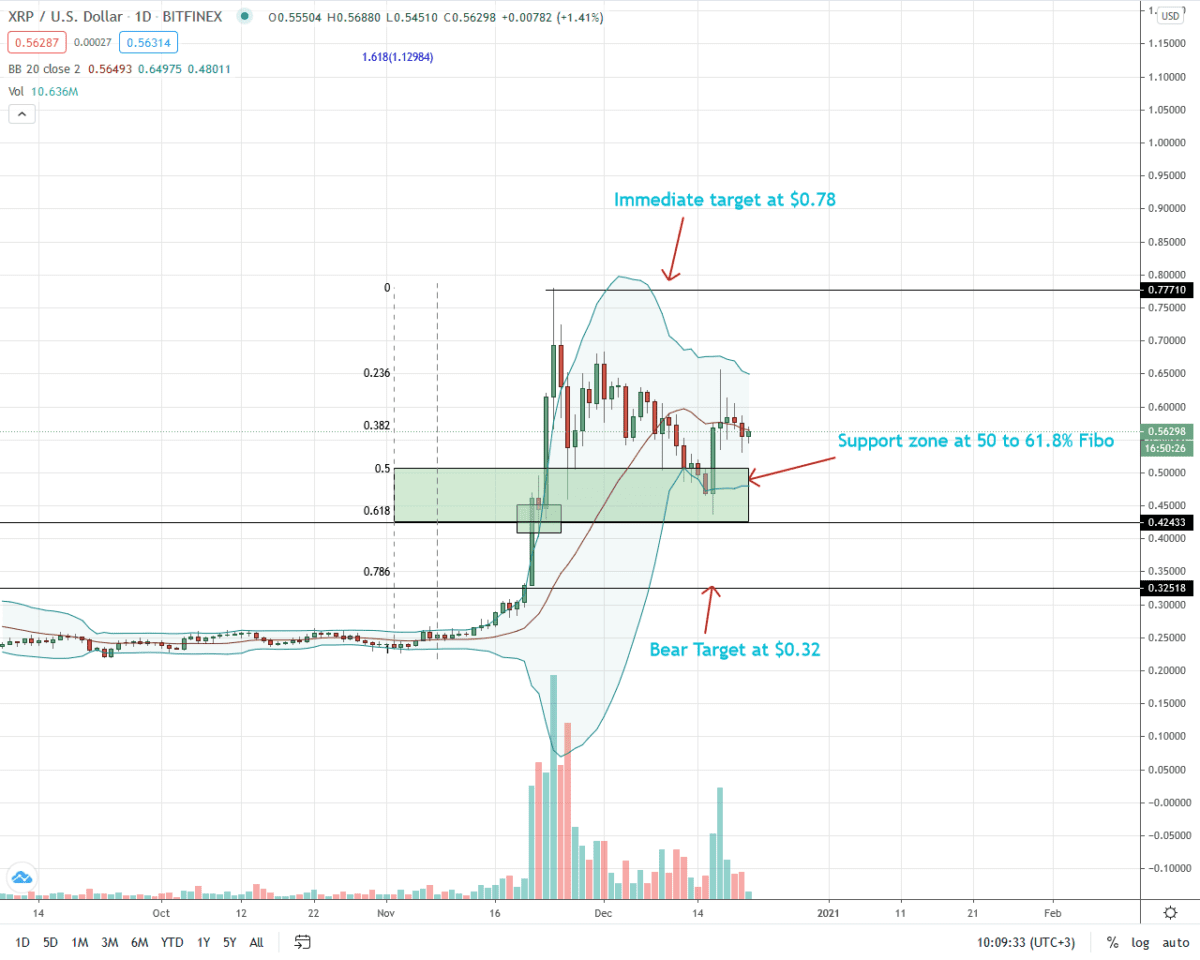

In the immediate term, traders are watching $0.43 and $0.65 levels marking the lows of Dec 15 and the high of Dec 17 for directions.

From volume analysis, the XRP/USD pair is within a $0.22 trade zone is overly net bullish. However, it is as long as bears are not successful in driving prices below $0.43 with high trading volumes.

On the flip side, the current ranging market can also turn out to be an accumulation if XRP bulls drive prices back above $0.65 with markedly high trading volumes.

In this case, the immediate bull target will be $0.78—or the Nov 2020 high.

XRP Market Movers for December

Propping XRP bulls in November was the Flare Network’s FLR airdrop.

The project is based in Ethereum but could bridge to the XRPL, enabling the use of XRP in DeFi. While the FLR airdrop was successful, XRP prices unexpectedly dumped before the reversals of Dec 16.

With the airdrop now stale, analysts are still confident on Ripple and XRP prospects citing the network’s potential to carve out considerable market share in remittance.

Ripple is already working towards the achievement of this goal through diversification via FLR DeFi, and lately, providing solutions for CBDC and stable coin issuers.

Herein, the objective is interoperability, and the XRPL can be a fitting network considering its energy-efficiency and scalability, different from Bitcoin and even Ethereum.

Ripple is also planning for smart contracting ability via Codius, a chess move now that Ripple is heavily involved in finance by providing rails for financial institutions.

For these reasons, Pantera Capital CEO, Dan Morehead, believes XRP and other altcoins shall outperform BTC. He says lower market cap altcoins like XRP with higher betas stand to gain as Bitcoin’s dominance drift lower in a correction from spot rates:

XRP Price Prediction for December

The XRP price is up eight percent in the last week of trading.

While XRP/USD pair consolidates within a 22 cents range, buyers are technically in charge.

A break above $0.65 could see the coin rally towards $0.78. Backing this preview are supportive candlestick arrangement. Notably, prices are reversing from the 50 to 61.8 percent Fibonacci retracement level of the November 2020 trade range.

Historically, this is an important reaction point. Often, prices tend to rise to now only the peak of the trading range but towards the 161.8 percent Fibonacci extension level anchoring on the range.

Therefore, if this guides, the XRP price might not only rally to $0.68—as volume analysis projects, but also to $1.1—the Fibonacci extension level of Nov 2020 range.

Losses below $0.43 invalidate this projection.

Disclaimer: Opinions expressed are not investment advice. Do your research.