Uniswap flips Chainlink and outperforms Bitcoin and Ethereum, firmly rooting its place in the cryptocurrency top 10 rankings by market capitalization. Trading at over $32, the DeFi token is now more valuable than Bitcoin Cash (BCH) and Chainlink.

As of Mar 8, the UNI price is up a massive 12 percent versus the greenback, stretching that to 44 percent week-to-date. Quite notably, even with the U.S. Senate approving the $1.9 Trillion Stimulus Package, the token has the upper hand against the BTC, adding nine percent on the last trading day.

Propping buyers are participants who drove even more value to the token on the last day.

According to trackers, the UNI average daily trading volumes are up 66 percent in the past 24 hours. However, there could be more traders in the immediate term since buyers are upbeat, expecting more refinement in the world’s largest decentralized exchange.

Uniswap Price Overview

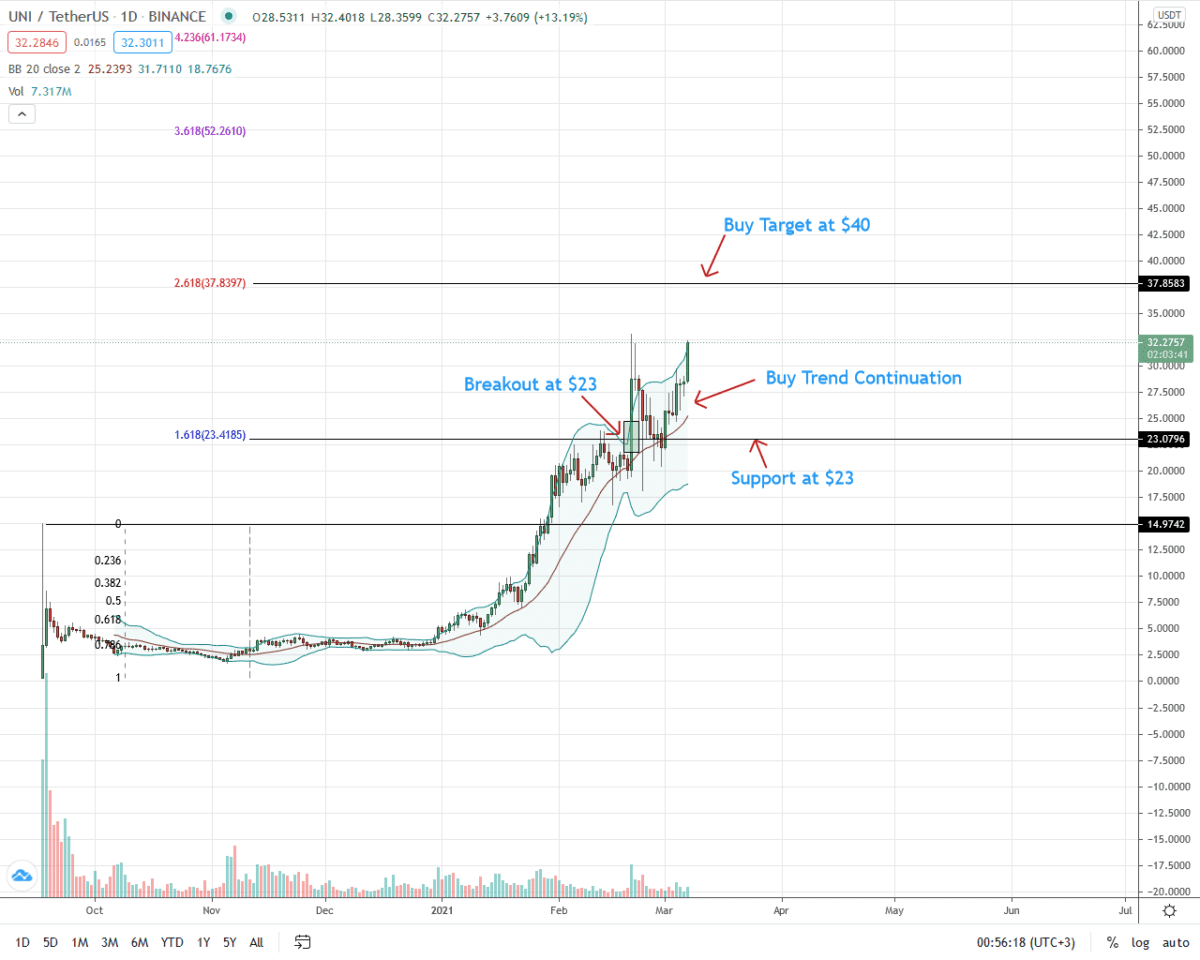

The Uniswap price is trading within a bullish continuation pattern. Backed by strong fundamentals and determined buyers, UNI/USD price is at around 2021 highs.

From the daily chart, support is offered by the middle BB on the lower end and $23. Considering the influx of buyers as visible over the weekend and the relentless wave of ramp pressure over the past few days shaking off sellers, the UNI/USD price could register new 2021 highs at over $40.

The buy target is from the Fibonacci extension tool pasted on the 2020 trade range. $40 flashes with the 2.618 Fibonacci extension level.

Still, the rapidity of the upside depends on the breakout’s strength above the Feb 2021 highs. A high volume close above Feb 20 highs is enough to lift the UNI price above $40–a new 2021 high, cementing the token’s position in the top-10.

Uniswap Market Movers

The project is open-source and the largest decentralized exchange in the world–rivaling centralized versions. Based in Ethereum, currently mired by high Gas fees, its creators are relentless in their development.

Their immediate objective is shifting to Layer-2 for lower transaction fees and better capital efficiency, reducing slippage, thereby improving user experience. Uniswap v3, according to Hayden Adams, will be able to compete with centralized versions.

Already, Uniswap has processed over $100 billion in cumulative trading volumes, a milestone for the public AMM-powered trading platform:

Registering $32 billion monthly volume in February 2021:

Ahead of this upgrade that may take shape in 2021, the UNI token is now available for trading in New York:

Uniswap Price Prediction

The Uniswap price is firmly bullish, flipping Chainlink and Bitcoin Cash.

From the daily chart, the path of least resistance is northwards. The middle BB—support, holds. The reversal from $23 confirms the 1.618 Fibonacci extension of the 2020 trade range as reliable support.

In the immediate term, the first buy target is $40. This is the 2.618 Fibonacci extension level, building on gains of Mar 7.

However, there would be more gains if the breakout bar above Feb 2021 highs has high trading volumes exceeding those of Feb 20. In such a case, the UNI/USDT price could easily glide to $50—or better.

A reversal forcing the UNI price below middle BB and $23 pours cold water on the uptrend.

Disclaimer: Opinions expressed are not investment advice. Do your research.