After posting stellar results in the last two weeks, Ethereum bulls appear to be slowing down.

Week-to-date, the Ethereum price maintains a bullish uptrend but is down roughly three percent. Of note, there appears to be a lack of momentum to sustain prices above $600 as judged from recent events.

At the time of writing (Dec 8), bulls are nonetheless in control. It is down three percent in the last week of trading but is stable in the past 24 hours versus the USD.

Ethereum Price Forecast Overview

Overly, the uptrend is firm. There are indications that buyers are accumulating in lower time frames as long as prices trend above support levels.

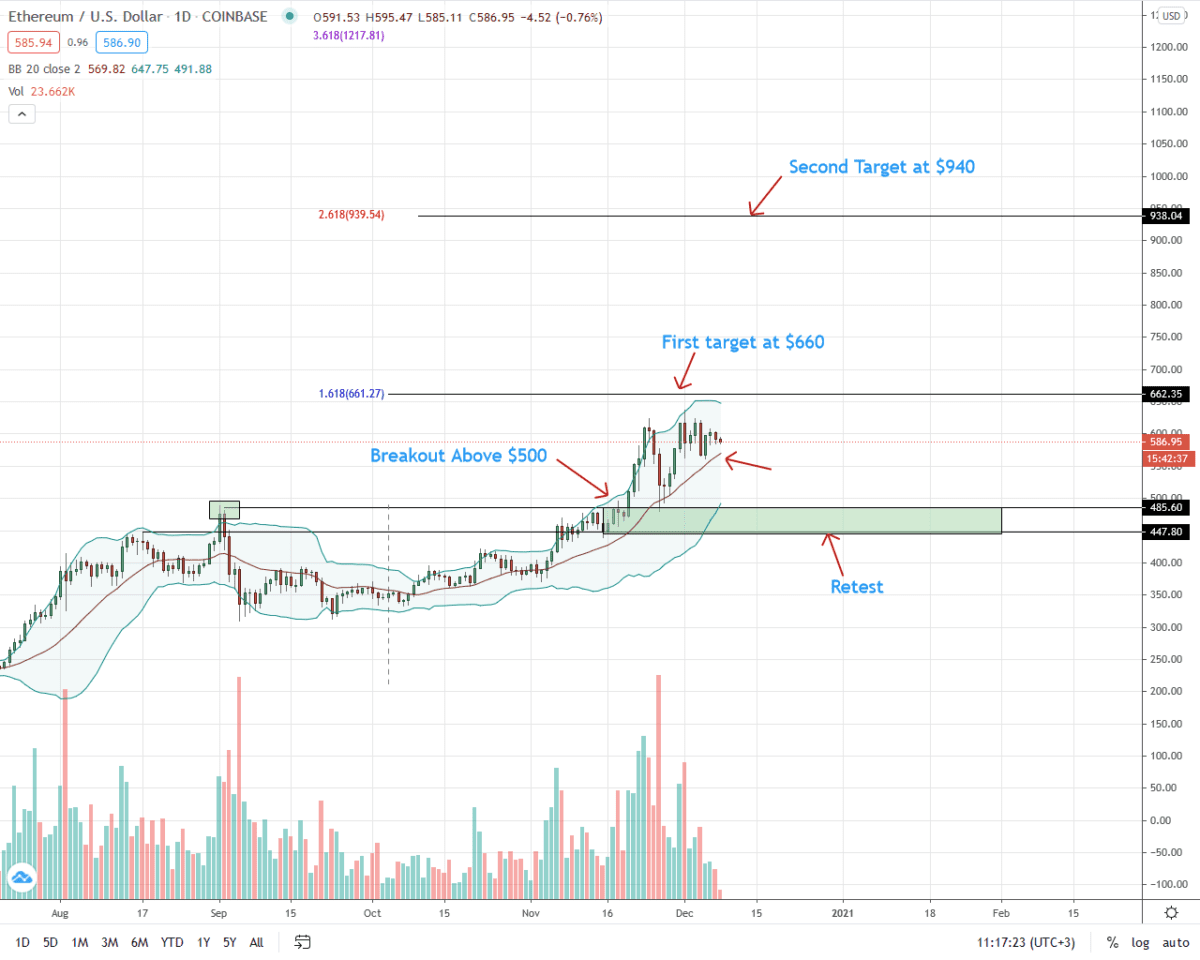

Prices are ranging within a $90 range in the daily chart. Key resistance levels lie between $640 and around $550 in the immediate term.

The middle BB—the 20-day moving average is also a support level to watch out for aggressive traders.

Notably, in the recent week of accumulation (distribution), the 20-day moving average has been a reliable support level. If broken, ETH/USD prices may dump down in the immediate term.

For buy trend continuation, there must be a break above $640. Preceding that ought to be decent trading volumes fanning buyers aiming for $660 and better in the days to come.

Ethereum (ETH) Market Movers

One week after the successful launch of Eth2 Phase 0, over one million ETH coins are locked by validators in the official deposit contract.

Like miners, Validators are tasked with transaction confirmation and security of the Beacon Chain mainnet. The security of the network is directly proportional to the number of validators. In turn, validators must lock 32 ETH and run a full node of Eth2—keep a local copy of the Beacon Chain mainnet.

For traders, what’s interesting is the mopping up of ETH coins in circulation by validators staking for above rate APRs. The more they stake, the more upward pressure there is for the ETH price–a net positive for traders angling for price gains.

Meanwhile, the number of ETH holders continue to rise.

According to the Blockchain analytics firm, GlassNode, the number of non-zero addresses rose to an all-time high of 50,318,311 on Dec 8.

This figure has been rising in the recent past. Possible reasons include DeFi, the potential of the Ethereum network itself, and the diversity of the smart contracting platform.

Even as Eth2 is in progress, developers are working on EIP-1559, a proposal to change the reward system in Eth1.

In the model, instead of the auctioning system, there will be a new BASE FEE and a small tip for miners in every block mined. The BASE FEE will be burnt—further reducing supply.

With this, there is better predictability of Gas fees.

Also, the elimination of auctioning will, over time, keep transaction fees lower since the race by miners to only confirm transactions tagged with higher fees will come to an end.

Ethereum Price Analysis

The uptrend is firm but participation is tapering as the secondary volumes chart shows.

From the daily chart, prices are in range mode. Aforementioned, resistance and support levels lie at $640 and $550, respectively. The middle BB is also an important reaction point.

For buyers to be in control, bulls must push prices above the current consolidation. Preferably, the break above $640 ought to be with high trading volumes exceeding those of Nov 26 (Coinbase data).

That may open the ETH/USD price to $660 to the upside and later $940 based on the Fibonacci extension level of the July to September trade range.

On the reverse side, a close below the distribution of Dec 1 to Dec 7 may spark a sell-off. The immediate support, in this case, will be the zone between $550 and $560, and the middle BB.

Bear target will be $480, or September 2020 highs.

Disclaimer: Opinions expressed are not investment advice. Do your research.