In Breif

- DeFi TVL is over $78 billion as of writing at the time of writing as per trackers.

- A higher TVL means better token valuation, a reason why traders are hopeful of more price expansion.

- Compound, of note, is reaping benefits.

- While recent COMP gains appear labored, bulls appear to be announcing their presence—and this is welcomed.

Compound Market Overview

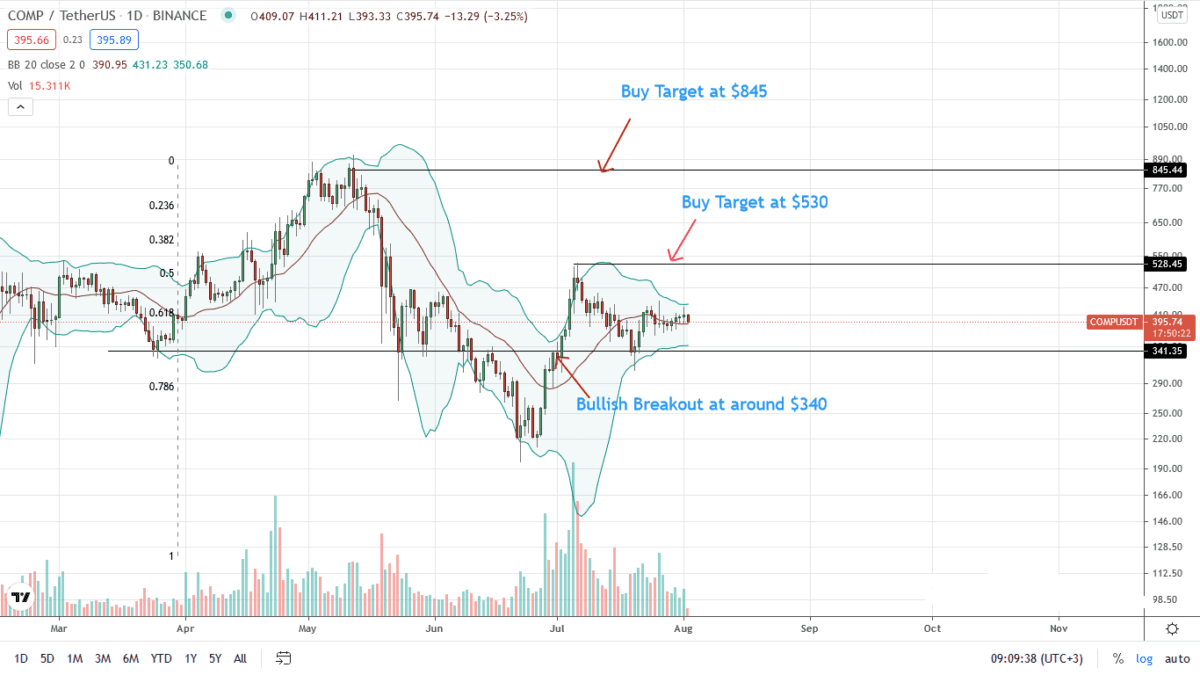

Reading from the daily price chart, COMP is trading within a bullish breakout pattern above the middle BB.

However, gains are not wide-ranging, and neither is participation off the charts.

If anything, there is a real risk that COMP prices could crash if there is a minor destabilization in the market.

As of August 2, COMP is stable versus the USD—dropping three percent on the last day, trending inside a $70 range with caps at $370 on the lower end and $440—July 2021 highs on the other.

While it is too early to make calls, the recovery, especially in ETH and BTC, could be the precursor for more gains in subsequent sessions.

As such, the odds of a break above $440 in a buy trend continuation pattern of the H2 July 2021 remain highs. If buyers are a success, a high-volume close above $440 could be the foundation for $530—or better in the upcoming days—effectively confirming that the consolidation of the last week of July was an accumulation.

Besides, it is discernible that gains from July 20 to spot levels completed the retest after COMP prices cratered from H1 July 2021 highs following the breakout of July 1.

Merging them creates a confluence–cementing the bullish bias of most market participants.

It is a preparation for a possible market-relieving expansion above immediate resistance levels to new H2 2021 highs, as aforementioned.

Compound Market Movers

There are several reasons why.

Compound is one of the first DeFi protocols. The release of the COMP governance token marked the beginning of the DeFi renaissance of early 2020. The Compound platform allows users to deposit supported tokens and earn interest.

Notably, Compound is driven primarily by the community. As such, it claims to have no partners. Firms or individuals claiming to have struck a deal with them are probably scammers, the protocol stated.

In late June, Compound announced the Compound Treasury, where USD deposits yield a four percent APR with guaranteed daily liquidity. The product is accessible to businesses and institutions, less all the complexities in crypto. The objective is to bring non-crypto companies from across the globe, not just in California, into the fold.

In addition, they continue to add more digital assets, recently adding AAVE and YFI into the fold:

At the same time, Compound has made it even cheaper for users in other markets to claim COMP tokens. Besides, the recently approved Proposal 050 allows for the liquidation of deprecated markets.

Compound Price Analysis

COMP/USDT finds itself in an exciting spot, compressed as per price action in the daily chart, dropping three percent on the last trading day.

Ranging inside a tight $70 consolidation, as mentioned earlier, COMP prices would recover, reaching $530 once $440 is conclusively broken in the days ahead.

On the lower end, any close below $370 with high trading volumes would invalidate the uptrend, allowing sellers of June to flow back. The short-term bear target, in that case, would be $340.

Disclaimer: Opinions expressed are not investment advice. Do your research.