The Cardano price is ebbing judging from price action in the daily chart.

While the uptrend is defined and ADA/USD traders expect a moonshot, sellers prevent bulls from pushing higher, resulting in consolidation.

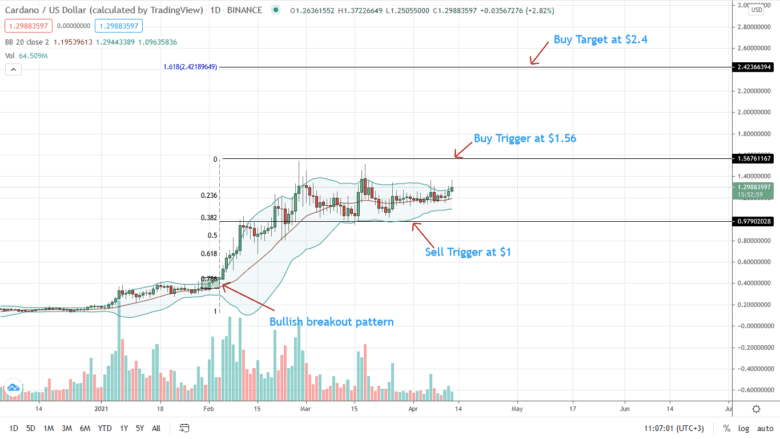

Most notably, prices continue to consolidate within a $0.56 range with clear caps at $1 on the downside and $1.56 on the upside.

As of writing on Apr 12, the ADA price is trading at $1.30, adding 10 percent on the last trading week.

On the brighter side, ADA trading volumes are relatively high, rising 89 percent on the last day of trading to $4.49 billion.

Cardano Price Overview

Aforementioned, the uptrend is clear as ADA/USD price is within a bullish breakout following sharp gains in late Jan 2021.

From the weekly chart, the ADA price is within a $0.56 zone with caps at $1 and $1.56 as bears press lower, draining ADA bulls’ momentum.

Perhaps the most distinct development is the long upper wicks suggesting liquidation in lower time frames. Buyers must build enough momentum and rip above the $1.30 and $1.56 zone for a trend continuation.

On the flip side, if Cardano bears take charge, forcing prices below $1, odds of deeper, protracted correction to the middle BB—even worse $0.40, could be on the offing.

Cardano Market Movers

Cardano is a smart contracting platform led by peer-reviewed research but still in development. Its native currency is ADA.

There have been steps towards Goguen and smart contracting as IOHK continues to activate several HFCs towards that end. Alonzo HFC is the latest.

Confidence is on the IOHK and Cardano Foundation team:

Once smart contracts activate, ADA holders are confident its price will soar, flipping ETH and BNB to second:

Presently, artists can create their NFTs—a few weeks before smart contracts activation:

Beyond this upgrade, Cardano on-chain data suggests growth, adoption, and more decentralization. The number of wallets and node operators rose double digits in the last month. These are all bullish signals for ADA price.

Cardano Price Analysis

The Cardano price remains in an uptrend, inside a bull flag. With buyers in control, the march to new levels above $1.56 is dented with low volatility, as the past few days’ price action suggests.

Every low, for aggressive traders, is an opportunity to load the dips with first targets at $1.56. However, for risk-averse traders, a breakout above $1.56 or $1 is worth the wait.

If ADA/USD bulls carry the day, prices could surge to $2.4—the 1.618 Fibonacci extension of the Q1 2021 trade range.

On the flip side, losses below $1 may see the ADA price crater to $0.44—the 78.6 percent Fibonacci retracement level of the Q1 2021 trade range.

Disclaimer: Opinions expressed are not investment advice. Do your research.