The Bitcoin price expected to grind higher, posting new highs and defying gravity as institutional and retail demand pump bulls.

In Summary

- As of writing on February 23, the BTC price is trading at over $53k, adding 12.6% week-to-date.

- Although prices have pulled back from 58K on February 21, Bitcoin is still up over 400% year-to-date.

- Michael Saylor, the CEO of MicroStrategy, announced on Friday that the firm has successfully raised $1.05 billion in debt offering to acquire more Bitcoin.

The coin has added an impressive 45 percent in the last three weeks from the daily price chart, apparently gliding following Tesla’s endorsement.

Propping buyers are confident buyers. As the BTC/USD price gallops higher, the BTC market cap is firmly above $1 trillion.

On the last day, the average trading volumes of the world’s most valuable trading volume are steady and may pick up in the course of the week.

This will reflect the sharp uptick of February 8, a confirming bull bar of late January 2021 price action.

Bitcoin (BTC) Price Overview

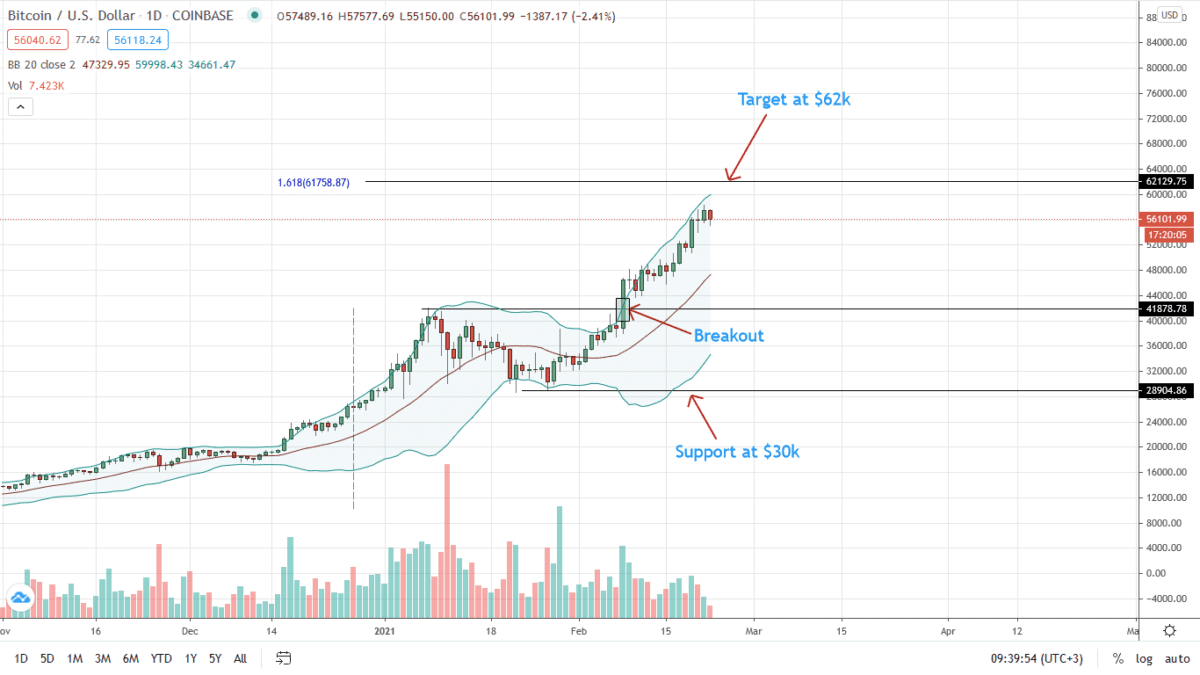

The BTC/USD price is trading within a bullish breakout pattern. Following gains above $50k—a psychological round number and a level of interest that further solidifies the trajectory set by determined buyers, there could be more room for Bitcoin bulls to ease past $60k.

However, determining the firmness of this breakout will be participation levels. Ideally, the surge past $60k and new 2021 highs should be with high trading volumes surpassing late January and early February 2021 averages. It will confirm the breakout bars of the last two weeks, opening up the coin to $100k in the medium term.

While leaning on caution, BTC/USD traders should watch the reaction at the middle BB and $50k—if there are sharp reversals from the current parabola.

The immediate resistance level is the $62k mark. It flashes with the 1.618 Fibonacci extension level of the Dec 2020 and January 2021 trade range. Sustained gains open up the BTC/USD price to $93k—the 2.618 Fibonacci extension level, $7k short of the $100k six-digit level.

Bitcoin (BTC) Market Movers

Bitcoin is a transactional layer and the first practical cryptocurrency. It acts as money. Over time, it has evolved to be a store of value. This property makes it a potential hedge against inflation.

The network now has a market capitalization exceeding $1 trillion, dominating 60 percent of the crypto market share.

It’s closely catching up with Google’s.

Meanwhile, companies have been asked to justify their lack of BTC exposure:

As more traders HODL:

Bitcoin may be undervalued at spot rates:

Meanwhile, MicroStrategy is stacking more. Could have its hand with over $1 billion of BTC by the end of the week:

Bitcoin Price Prediction

Immediate support is provided by the middle BB—the 20-day moving average and $50k on the lower end.

If bulls sustain this momentum, the immediate target is $62k. This is the 1.618 Fibonacci extension level of the Dec 2020 and January 2021 trade range.

The surge to spot level is, nonetheless, with low trading volumes. Therefore, the odds of a retrace are high if volumes don’t pick up in the course of the week.

Ideally, a buildup of participation towards $60k and the break above the immediate resistance and bull target at $62k will see the BTC/USD price reach $93k in the medium term.

On the flip side, a sharp retracement below $50k will slow down bulls.

Disclaimer: Opinions expressed are not investment advice. Do your research.