Well, everybody can see it. Better still, every cryptocurrency investor, enthusiast, or trader can feel it. Bulls are awake and the home pages of all crypto trackers are back to green. Yes, green and gains are massive.

Double-digit for Bitcoin which in turn is magnifying gains in other altcoins. Leading in the gainers’ category in the top 10 is Bitcoin Cash and his cousin, Litecoin. The former is a spinoff of Bitcoin and the latter derived its code from the king, Bitcoin.

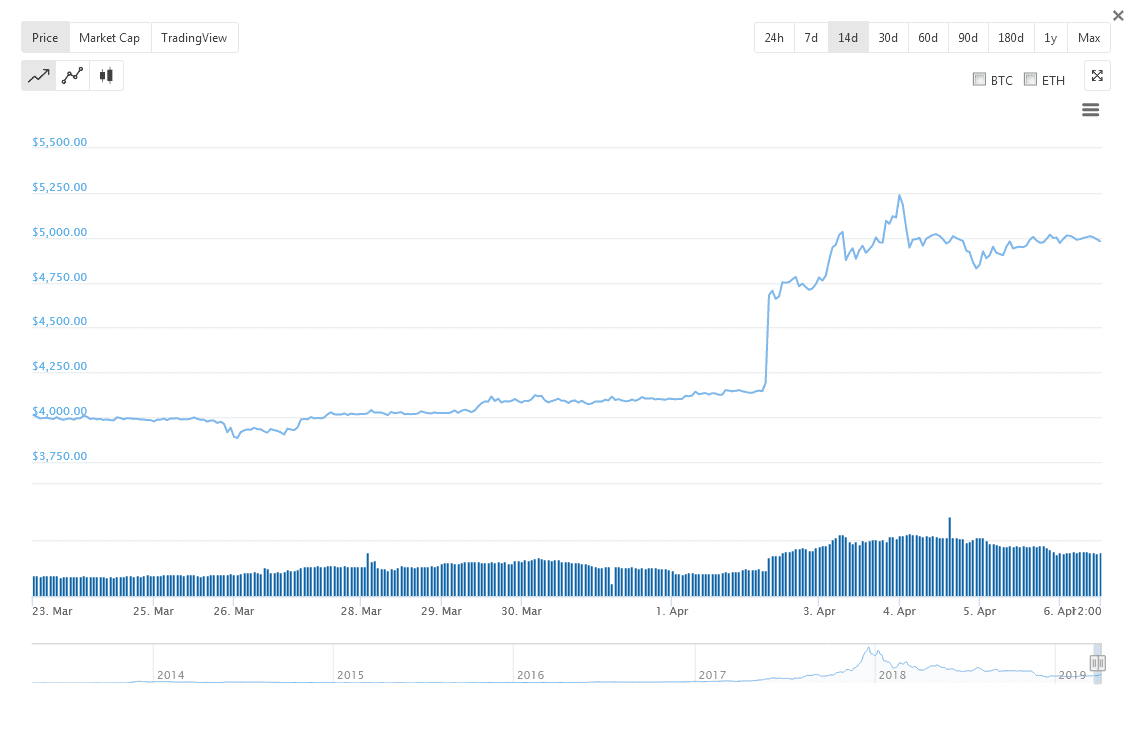

$100 Million Worth of Bitcoin Pump the Market

Amid all the excitement, analysts, as well as blockchain sleuths, are trying to figure out why asset prices are rallying. One theory is that there was a huge $100 million buy order distributed across three liquid exchanges causing an imbalance as prices rallied to the stratosphere. Here’s what Oliver von Landsberg-Sadie, Chief Executive Officer of BCB Group told Reuters:

“There has been a single order that has been algorithmically-managed across these three venues, of around 20,000 BTC. If you look at the volumes on each of those three exchanges – there were in-concert, synchronized, units of volume of around 7,000 BTC in an hour.”

And they were right. A similar study carried out by Sid Shekhar, the co-founder of TokenAnalyst, did complement Oliver’s observation. He’s what Sid said:

“We were able to see some of this stuff before it happened. We saw a few large whale movements of funds, then a concerted inflow into multiple exchanges from whale wallets, and then we were seeing a virtuous cycle. The whales didn’t move it all by themselves, but they were the first domino. As soon as that first domino fell, we saw a bunch of programmatic action based on momentum, which led to more and more price action.”

Enter the US SEC

So, the fact is, the initial 20 percent swing was because of a Bitcoin whale who wanted to get all in before “something” big happened. Whether that will be the US SEC approving any of the nine Bitcoin ETF applications or China easing their stand on Bitcoin and allowing exchanges back but in a more regulated manner we don’t know.

However, what we know is that the US is allowing market forces to influence digital asset prices. To streamline and to assist investors make correct decisions by ensuring that they invest in utilities and not securities—SEC are adamant that most digital assets are “investment contracts” compliant with Howey Test. Back in Mar, Brett Redfearn who heads the commission’s head of trading noted the following:

“When you have an unregulated space, bad actors do tend to flock there and so if you look at the amount of enforcement cases that have come and the amount of manipulation and fraud and all of the other things – bad sales practices and the like – that have happened in that space, it’s astronomical.”