The AAVE token is, among other DeFi governance coins defying gravity.

It could be due to the rise of DeFi TVL, also driven by the expanding Ethereum prices.

However, regardless of the interconnections, the path of least resistance for AAVE is northwards—and the token’s bulls are undoubtedly upbeat.

AAVE Market Overview

From the daily chart, AAVE prices are stable on the last trading day.

The token is up 17 percent in the last week of trading, outperforming ETH and BTC.

Overly, trading volumes are decent, buoying buyers who, in turn, are keeping the uptrend firm, a net positive for AAVE traders across the board.

Zooming in to price action, AAVE buyers are resilient.

The last week of trading has resulted in gains even though the upswing is labored. It is a mix of green and red, with AAVE closing the week in red, reading from the daily chart.

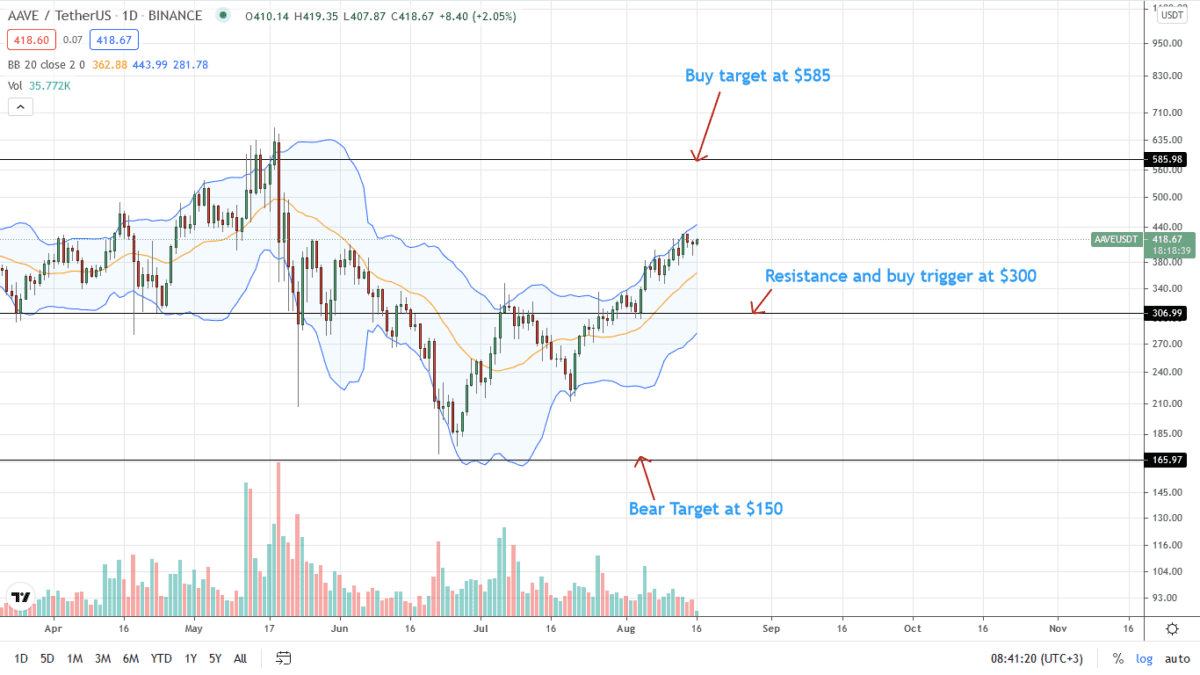

In all, AAVE prices are in a bullish breakout pattern firmly above July 2021 highs.

Also, amid the uptrend, AAVE bulls consistently band along the upper BB, suggesting underlying momentum keeping bulls alive.

Another marker of strength could be the positively inclined middle BB.

The 20-day moving average is positively inclined, changing trajectory highlighting the shift in strength once AAVE prices began bottoming up.

Technically, it would be ideal if the middle BB continues to offer support. At the same time, bulls confirm the bullish breakout pattern above July 2021 highs at $300.

A retracement below $350 would cancel the uptrend. In this case, this will pave the road for a retracement as per the layout of AAVE candlesticks.

AAVE Market Overview

Data from Defi Pulse indicates that AAVE locks the most. It has a TVL of $12.7 billion, $2 billion more than the nearest competing protocol, InstaDapp.

AAVE is a lending and borrowing protocol whose code has been audited by two blockchain security firms. At the same time, it maintains a bug bounty program.

Responding to high Gas fees in Ethereum, AAVE’s services are also accessible in the Ethereum-compatible Polygon. Through the latter, borrowing and lending costs are near-free, a net positive which significantly boost user experience.

In late July 2021, the collateral swap feature was launched on Polygon:

At the same time, they maintain an active grants program. Their funding of the Boardroom saw them integrated:

All this is as they develop. Stani, the founder, recently revealed that a new version of AAVE was be audited:

AAVE Price Analysis

The path of least resistance is upwards despite the rejection of higher highs, as evident in the daily chart.

Week-to-date, AAVE is up 17 percent versus the greenback.

In a bullish breakout pattern with $300 as the primary support, every low may offer a loading opportunity for aggressive traders.

It is provided prices trend above the middle BB and preferably $350—odds of bulls staying put is high. AAVE bull bars are banding along with the upper BB signaling strength.

A close above $430 and last week’s highs could further pump AAVE bulls who, in turn, would train their guns to $585—May 2021 highs.

Disclaimer: Opinions expressed are not investment advice. Do your research.