The Ethereum price, for what the project presents, is closely watched. Currently, the coin is relatively stable, inching higher and away from the tepid price action of last week.

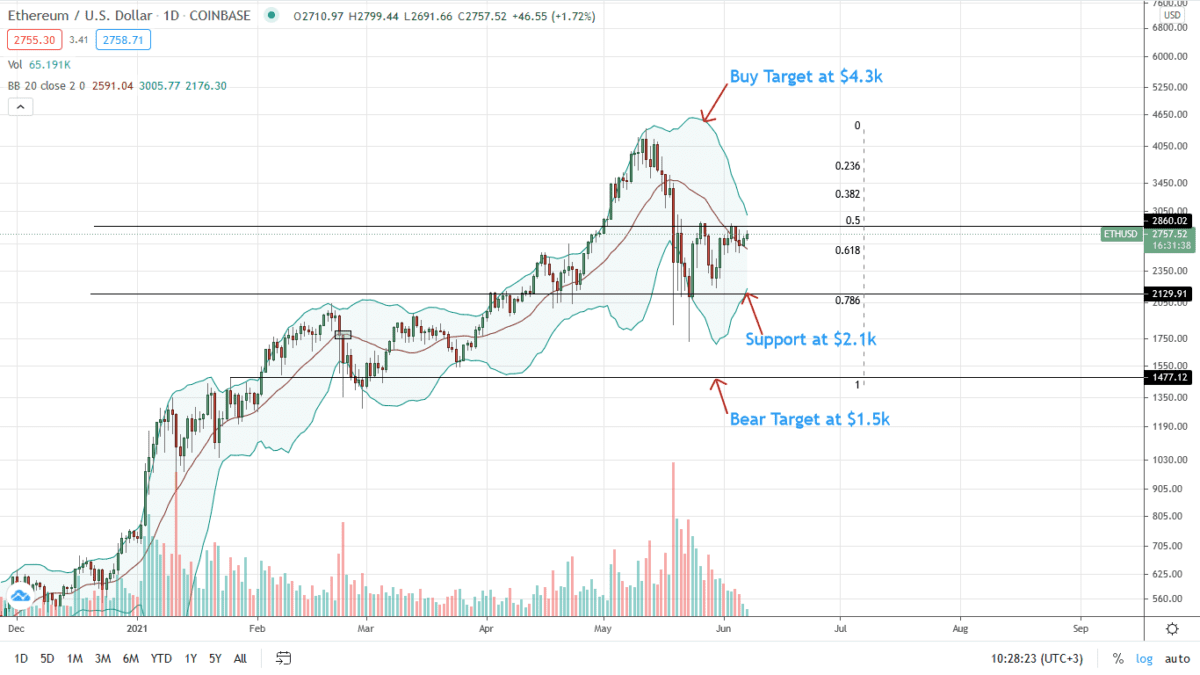

Whether the flat-lining will continue this week depends on several Ethereum technical analysis factors. One of them is the reaction at $2.5k and $3k on the upside.

The latter is a psychological mark that, if broken, may trigger another wave higher towards $4k—or better.

ETH is stable on the last trading day and encouragingly up 12 percent week-to-date versus the greenback at the time of writing.

Additionally, it outperformed BTC on the same time frame with decent trading volumes at around $33 billion.

Ethereum Market Overview

Chartists are split in light of the ETH/USD candlestick arrangement.

On the one hand, ETH/USD prices are grinding higher, retesting, and even closing above the middle BB. The 20-day moving average is the immediate resistance level.

If comprehensively broken to the upside, ETH bulls may find a solid anchor to rally towards $4k and print new highs in the medium-term.

On the other side, some analysts are pessimistic.

For instance, even with the expansion of ETH prices from the tail-end of May 2021, there are hints of weakness. ETH/USD prices are still trading inside May 19 high-volume bear that.

The main distinguishing movement casting a shadow of doubt on ETH bulls is participation even behind the double bar bullish reversal pattern of May 23 and 24.

Comparatively low trading volumes suggest weakness in uptrend from an Effort-versus-Results perspective, giving ETH bears an upper hand.

Ethereum Market Movers

Admittedly, Ethereum struggles with scalability troubles and fluctuating Gas fees.

A few weeks after Gas rose to $69. After that, it has sharply contracted to around $4, according to trackers.

The project, nonetheless, plans to address Gas and scalability concerns.

One, the London upgrade is in a few weeks:

Intensive dApps plans to migrate to Layer-2 solutions and EVM-compatible projects like Polygon.

Arbitrum is live, and Loopring is already gaining traction.

Optimism will soon launch. Combined with Sharding, Layer-2 will have a multiplicative effect on scalability, boosting Ethereum stature.

Ethereum prices are now decoupled from Bitcoin, and this may persist going forward as influencing fundamentals diverge.

Ethereum Technical Analysis

The Ethereum price is steady at spot rates.

For advances made over the weekend, ETH/USD is up 12 percent against the greenback.

There are gains made, forcing ETH prices above the middle BB.

However, gains above $2.9k—last week’s highs may trigger demand, driving prices towards $3.4k—May 19 highs and the 38.2 percent Fibonacci retracement level of the March to May trade range.

If there is a dump below the middle BB, forcing ETH bulls to retreat, prices may slide back towards $2.1k in a bear trend continuation as price action snap back in line with May 19 losses.

Disclaimer: Opinions expressed are not investment advice. Do your research.